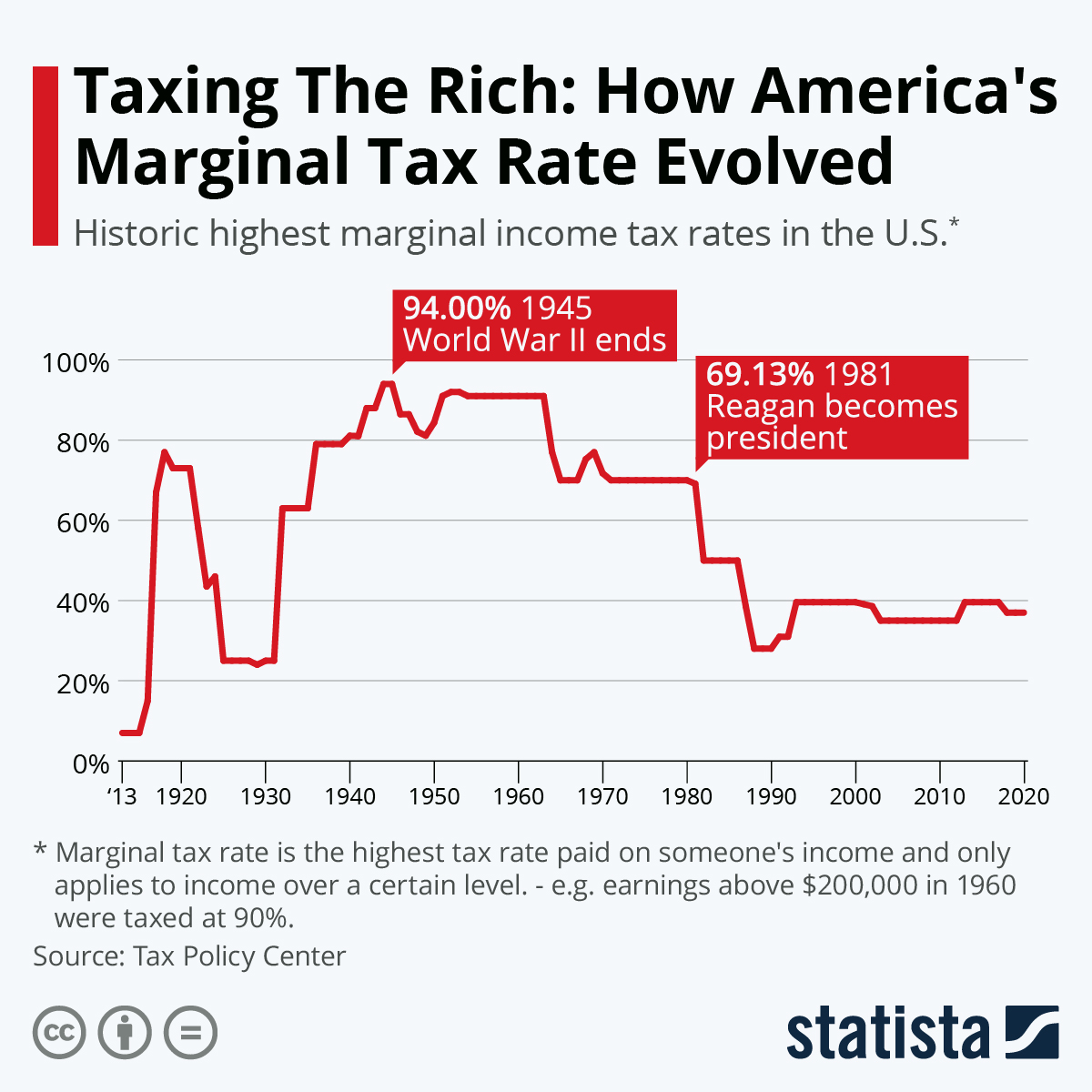

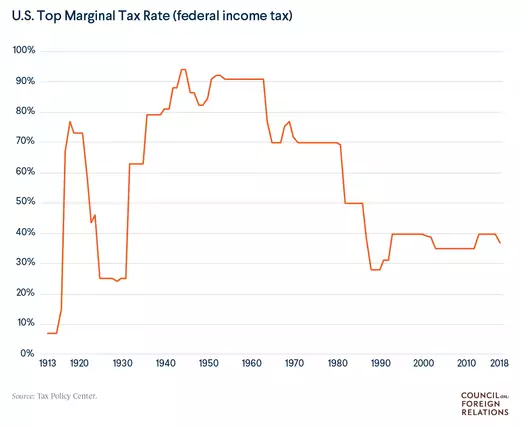

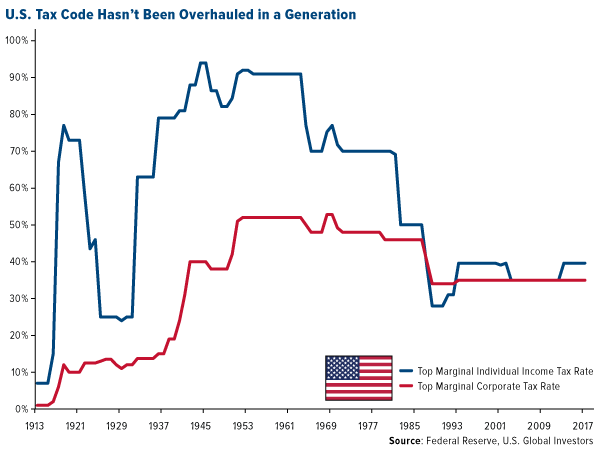

US Top Marginal Income Tax Rates 1913 To 2017: For Individuals vs. Corporations | TopForeignStocks.com

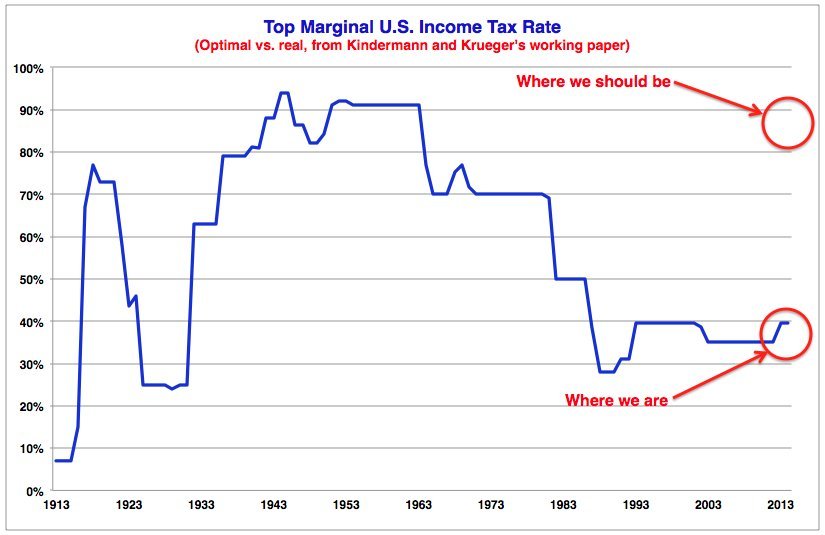

Top income tax rates 1900-2013. Source: piketty.pse.ens.fr/capital21c... | Download Scientific Diagram

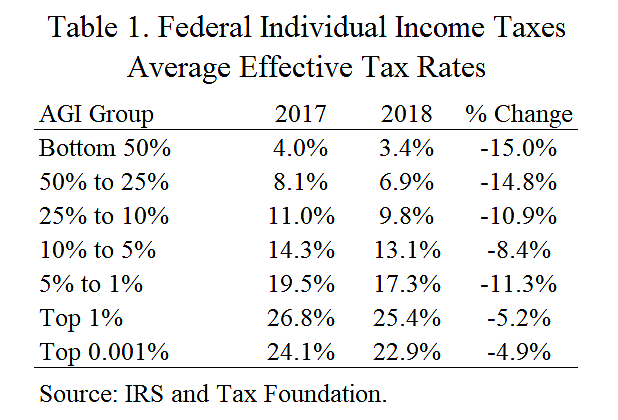

Chart of the Day: The Inverse Relationship Between the Top Marginal Income Tax Rate and the Tax Burden on 'the Rich' | American Enterprise Institute - AEI

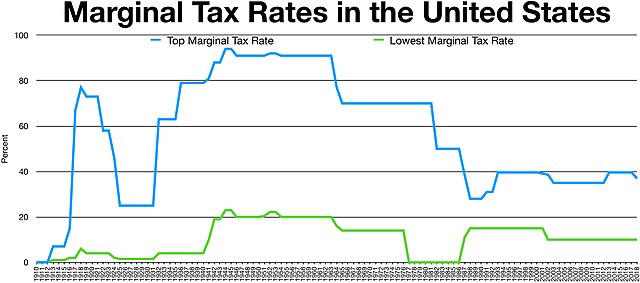

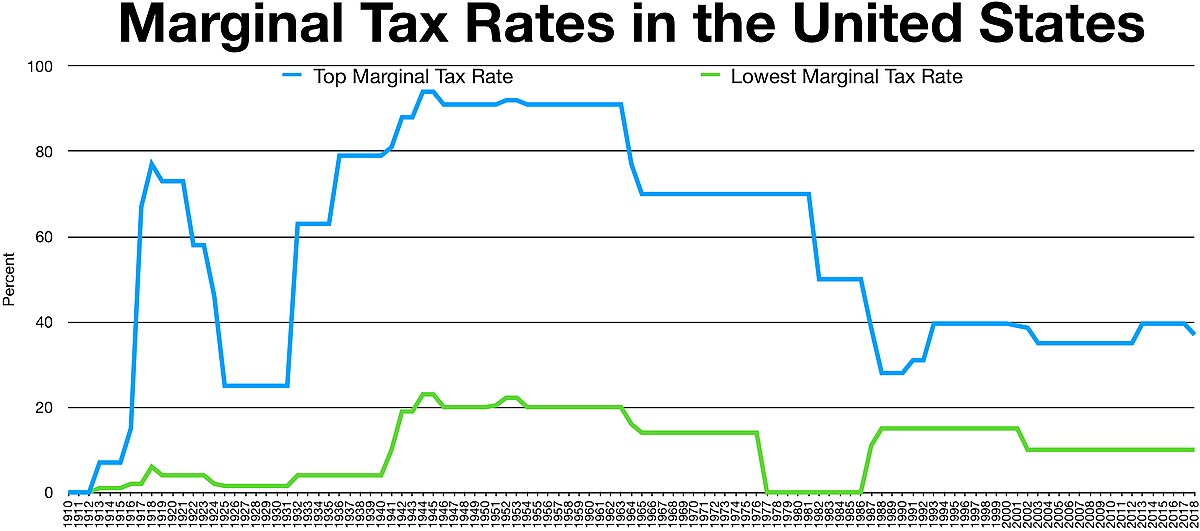

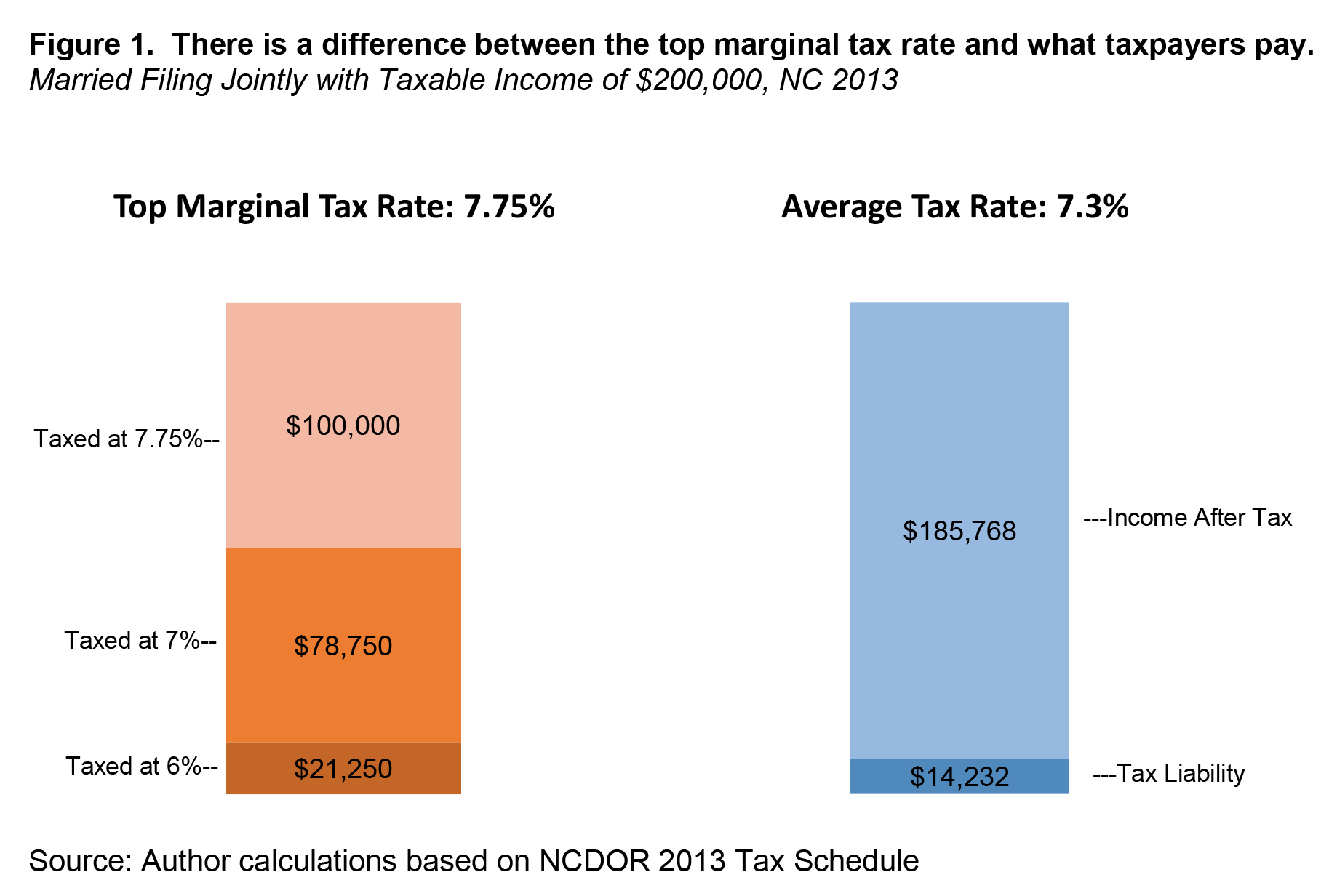

Higher Rates on Higher Income: Why a Graduated Income Tax is Good Policy for North Carolina – North Carolina Justice Center

![Top 1 Percent" Pays Half of State Income Taxes [EconTax Blog] Top 1 Percent" Pays Half of State Income Taxes [EconTax Blog]](https://lao.ca.gov/Blog/Media/Image/6)