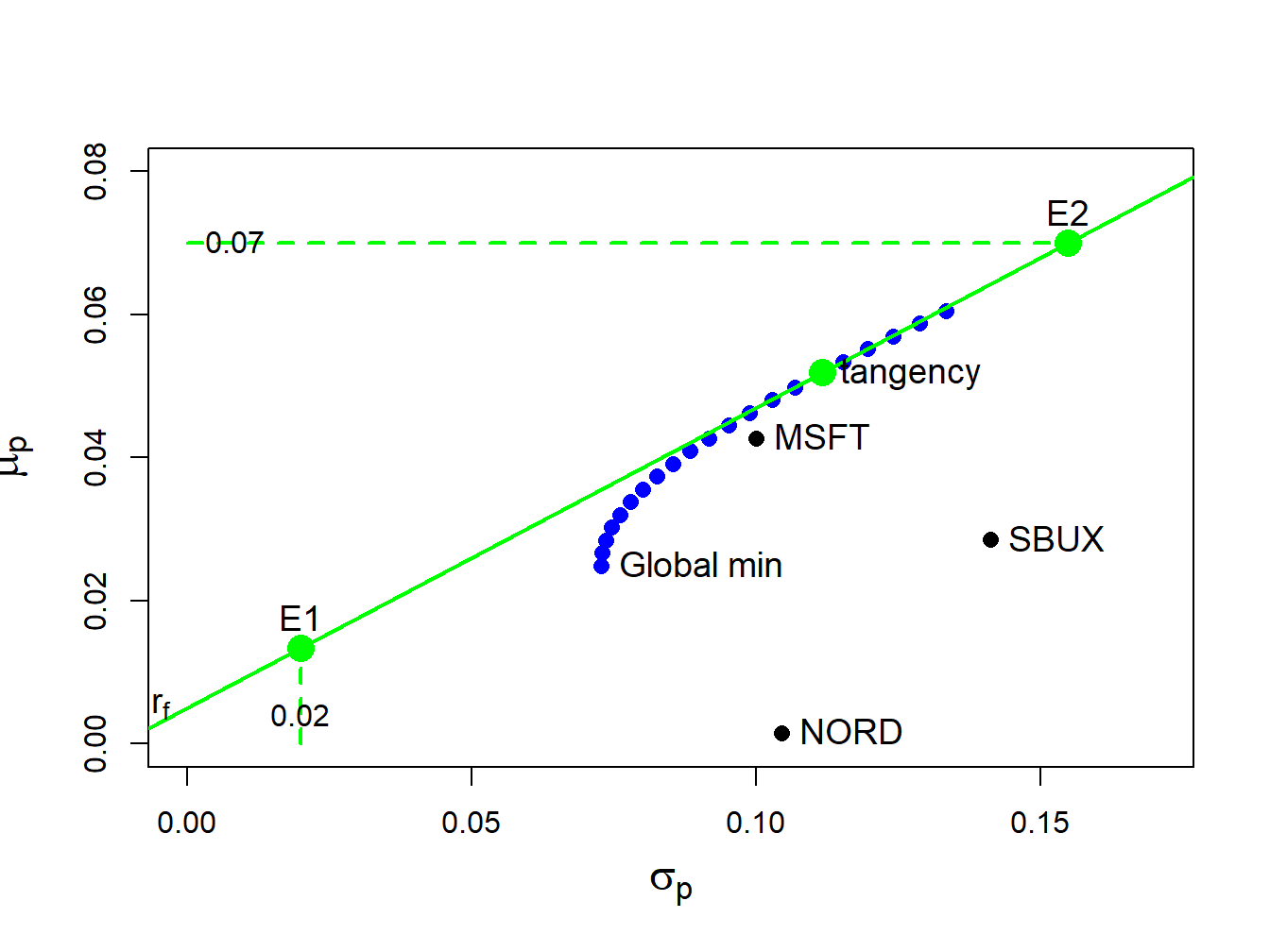

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

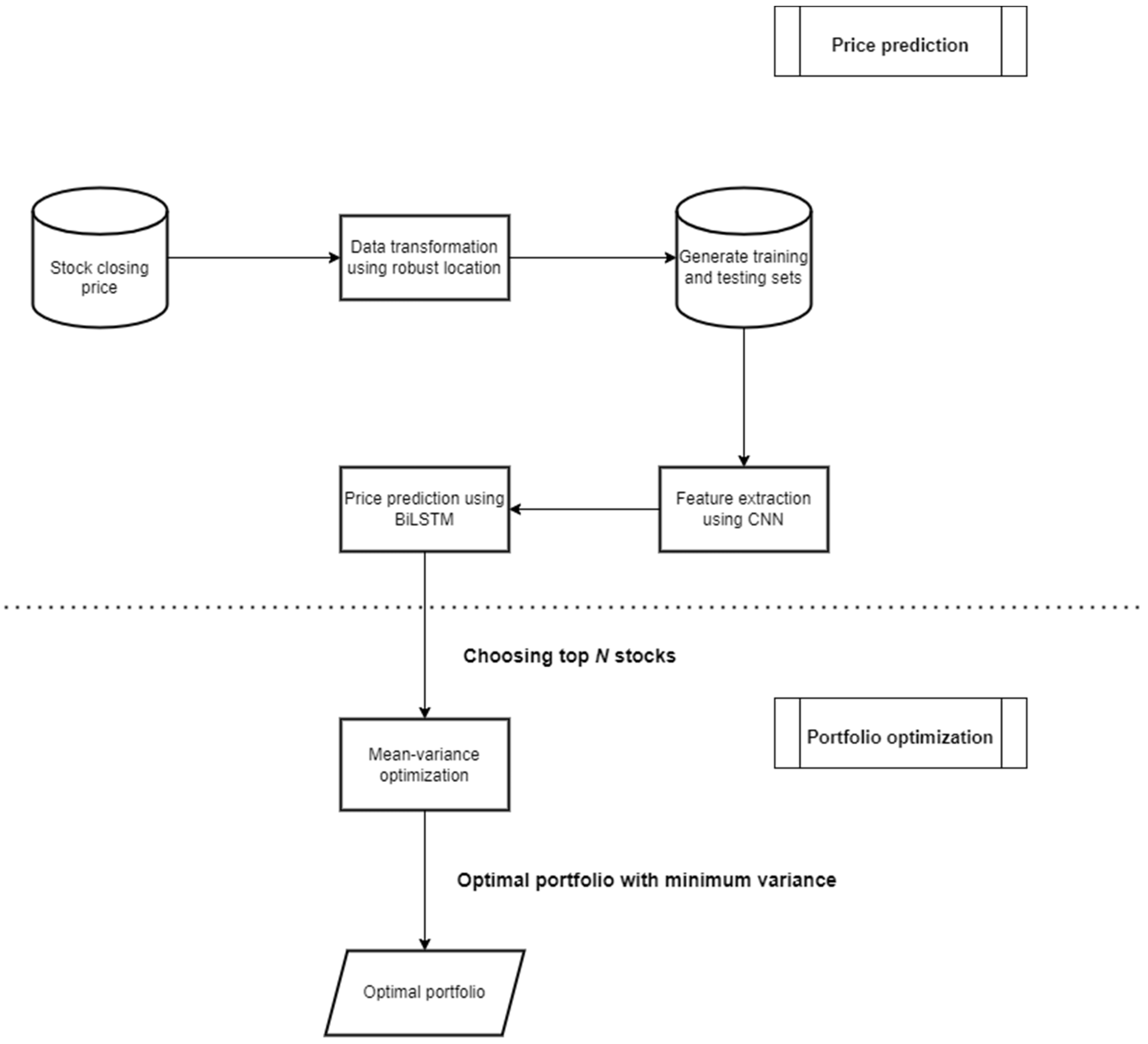

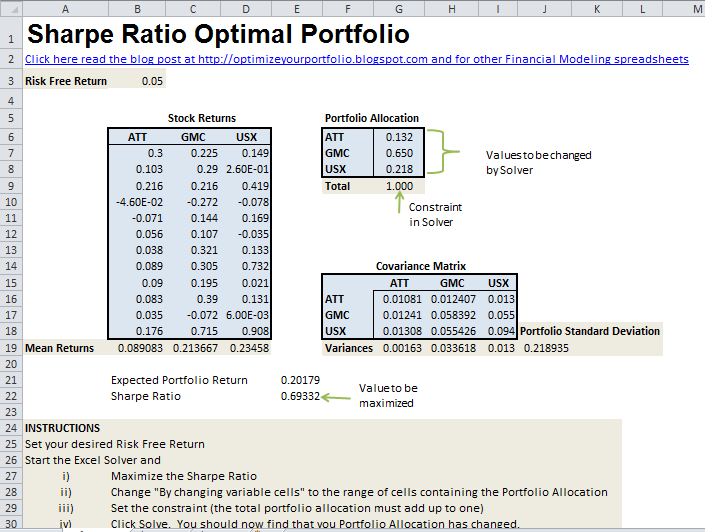

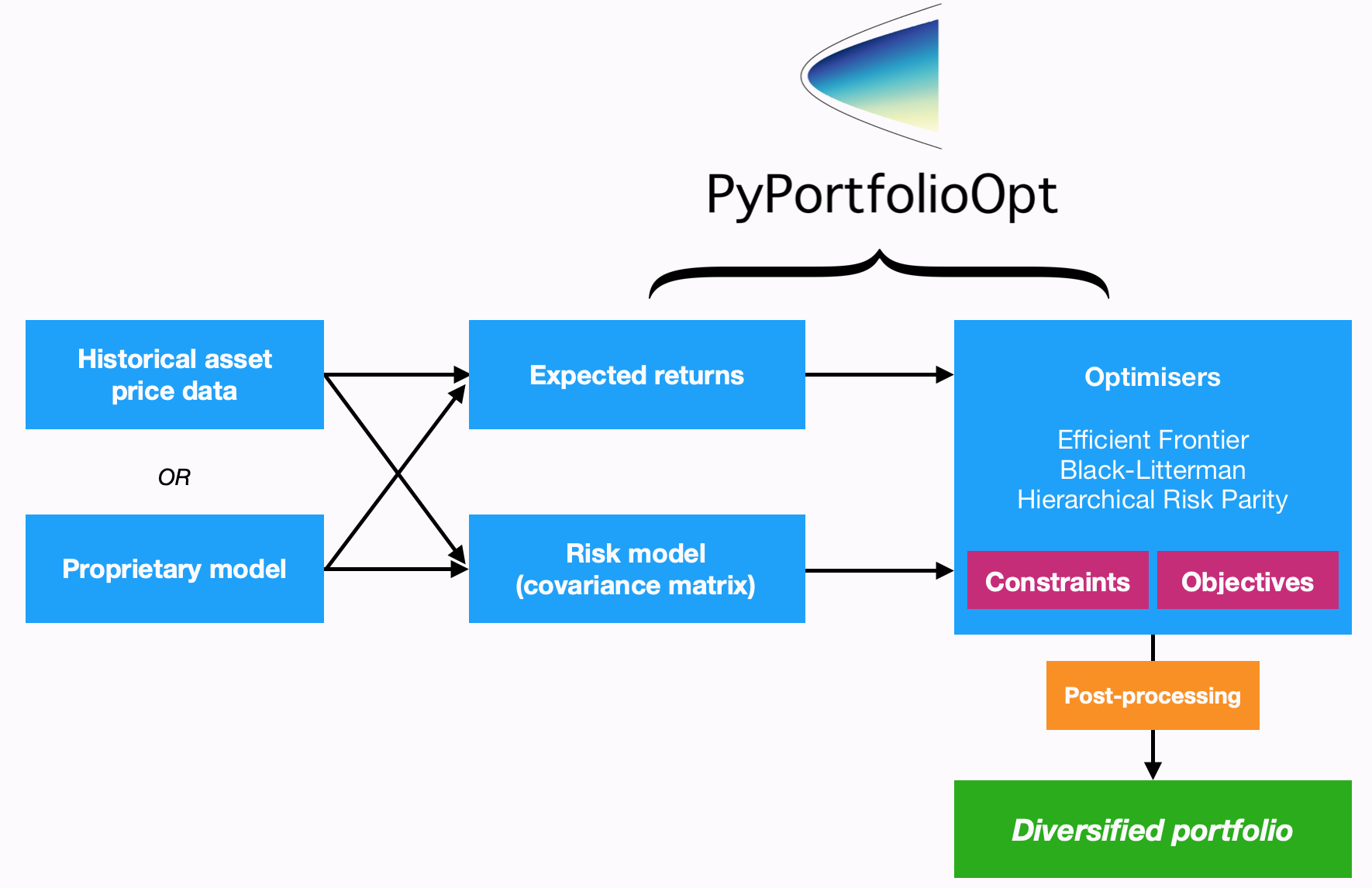

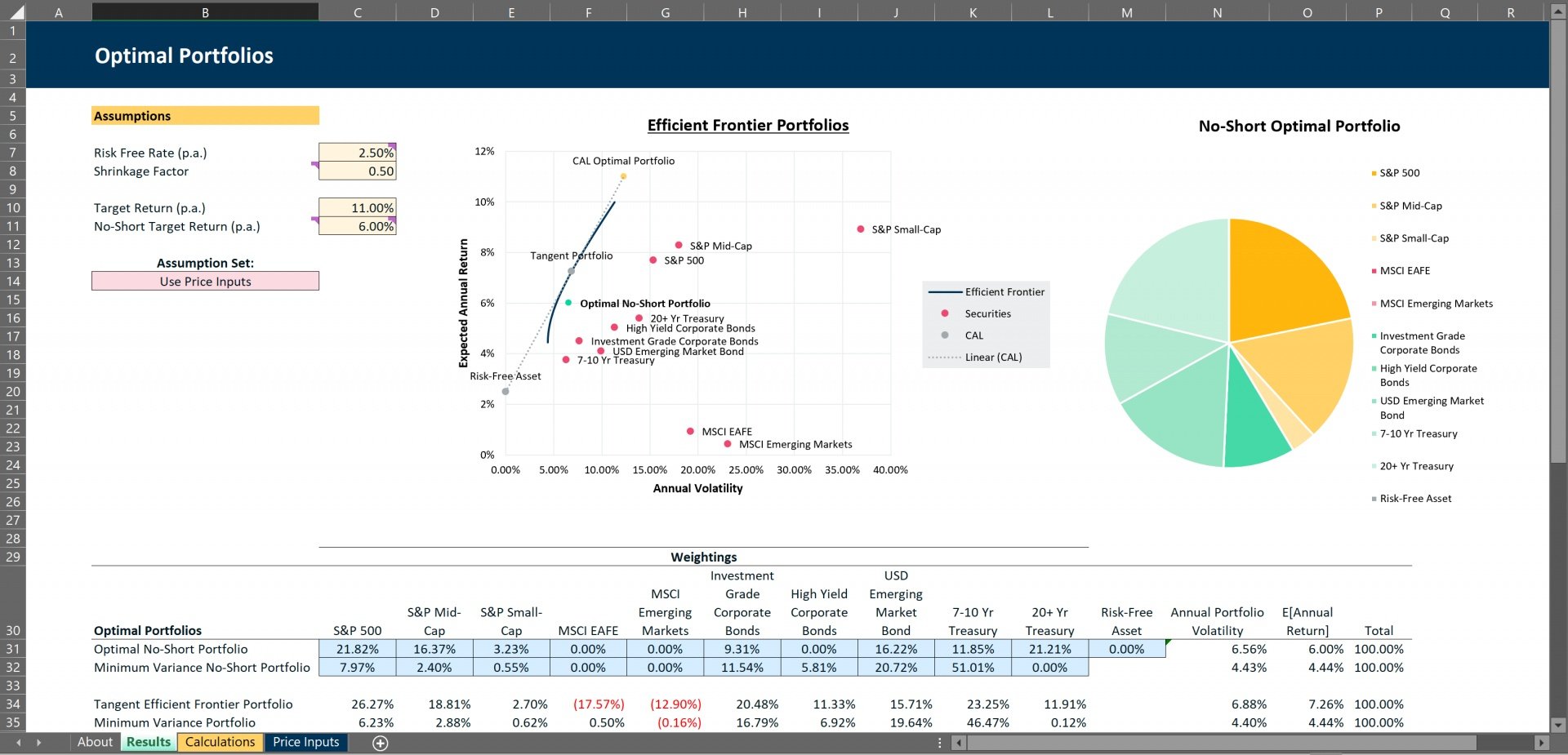

Algorithmic trading simplified: Value at Risk and Portfolio Optimization | by Munesh Lakhey | Medium

Photonic matrix multiplication lights up photonic accelerator and beyond | Light: Science & Applications

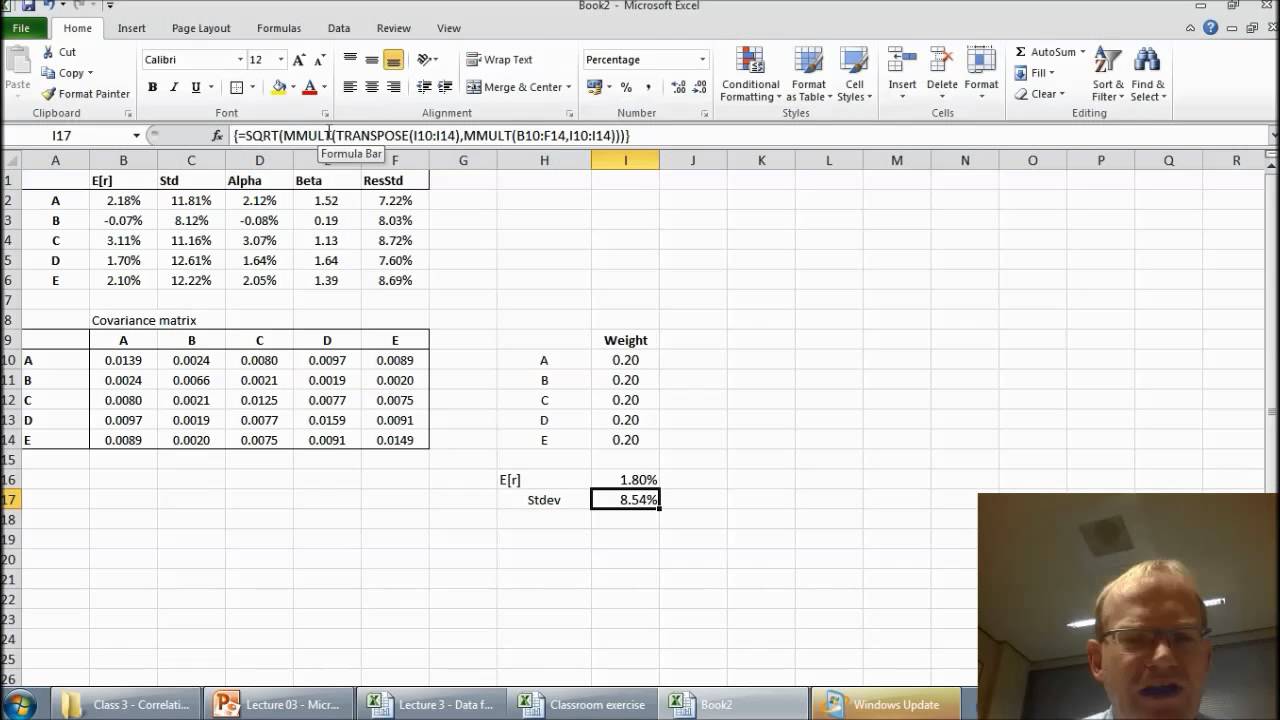

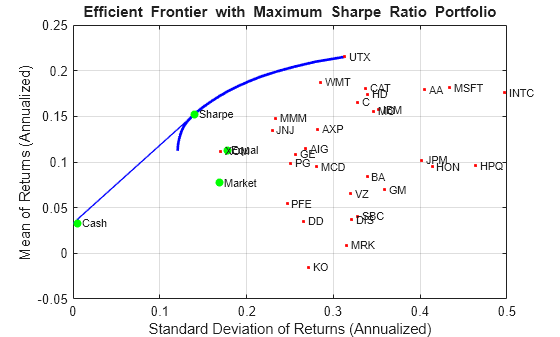

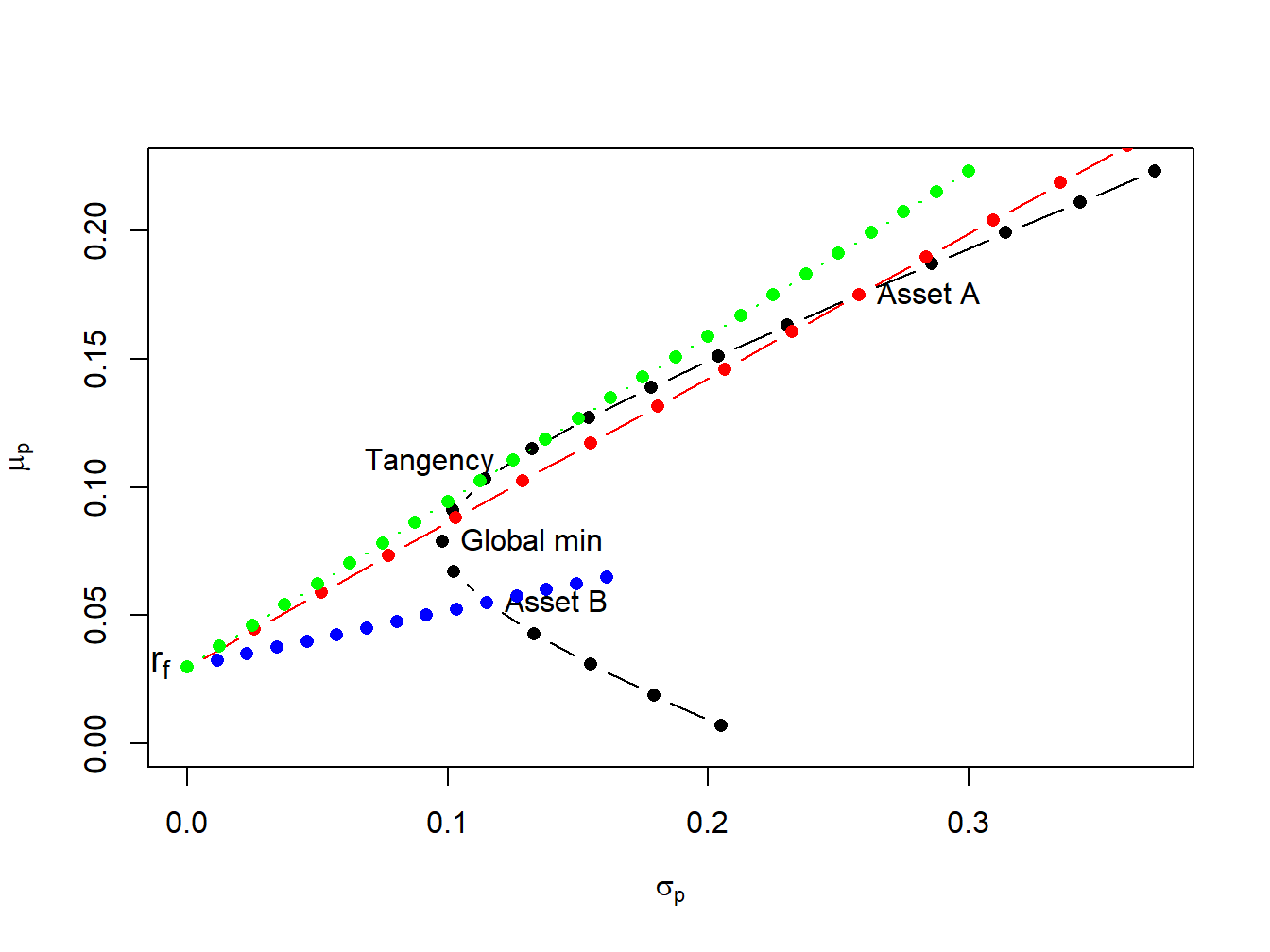

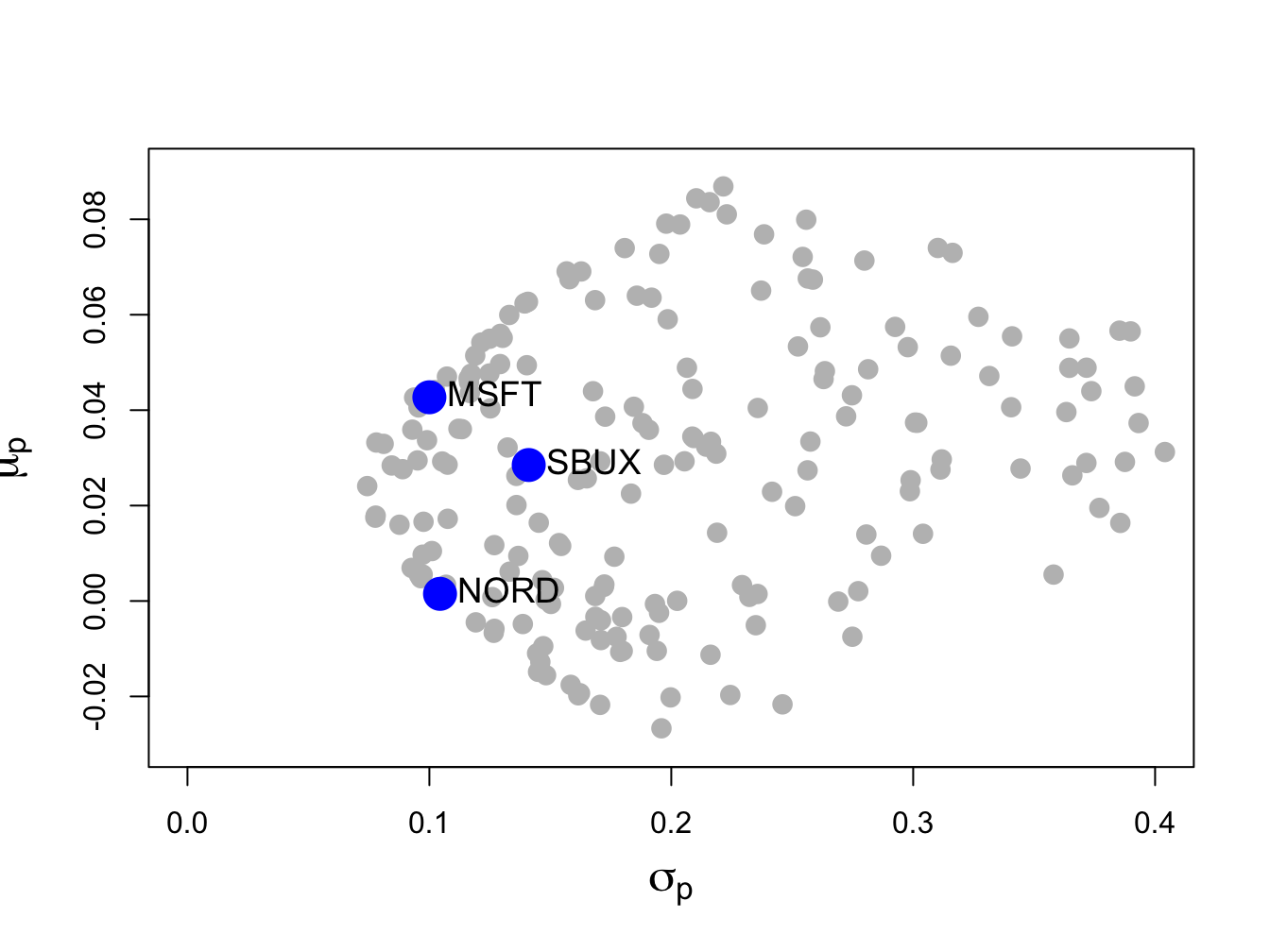

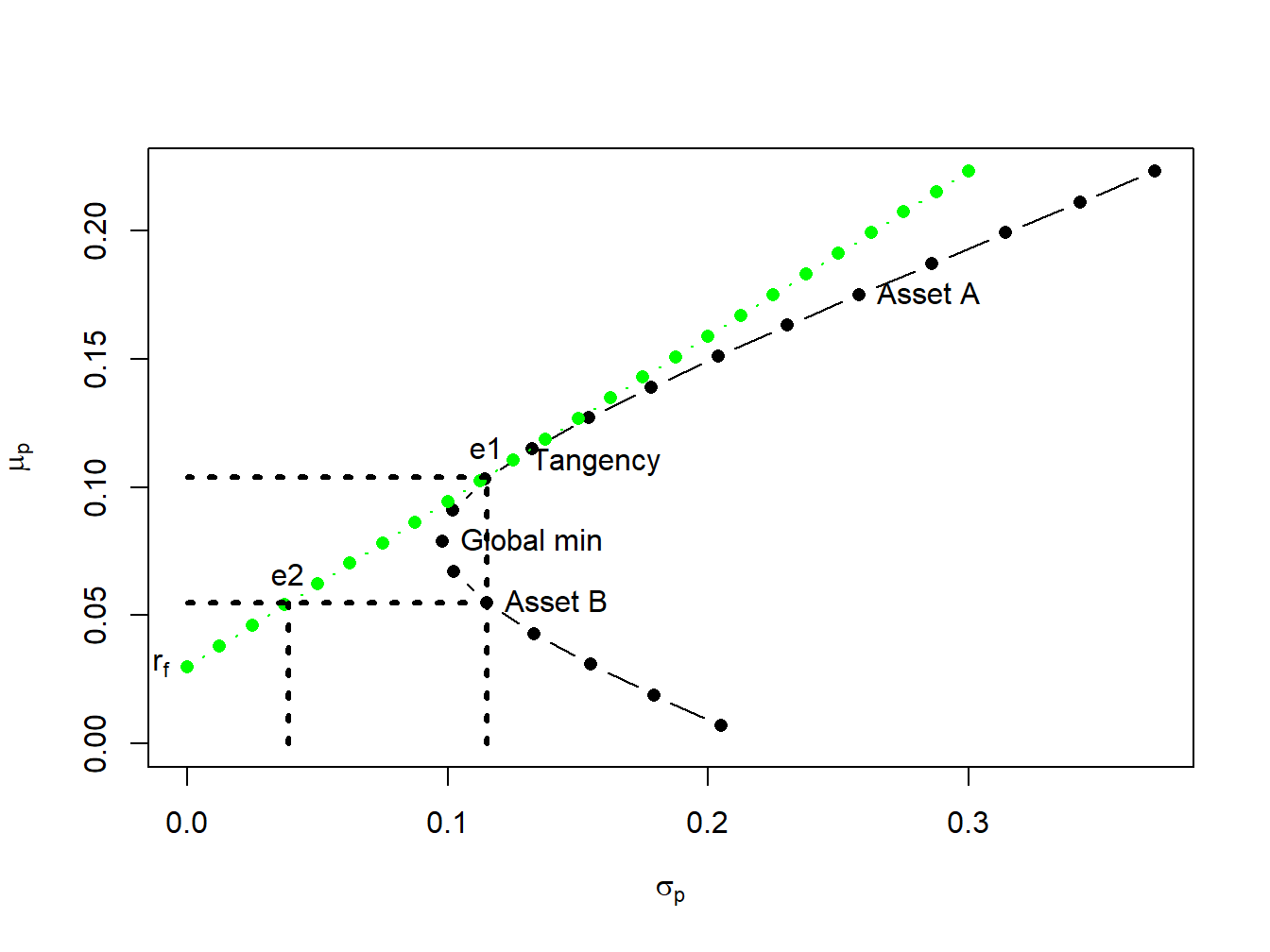

12 Portfolio Theory with Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

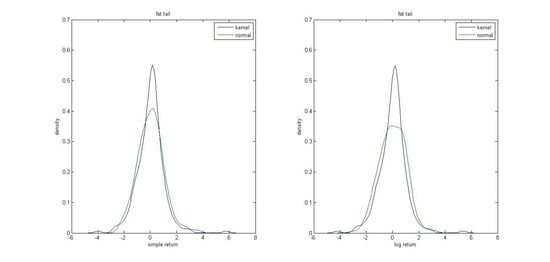

JRFM | Free Full-Text | Improved Covariance Matrix Estimation for Portfolio Risk Measurement: A Review

Smart alternative for brute force nested looping minimum variance approach? - AFL Programming - AmiBroker Community Forum

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange